Merrill Edge Extended Hours Trading

Merrill Edge Extended Hours Trading In the dynamic world of stock trading, the ability to trade outside of standard market hours can be a game-changer. Merrill Edge, a subsidiary of Bank of America, offers extended hours of trading, allowing traders to capitalize on opportunities that arise outside the regular trading session. Let’s dive deep into the world of extended hours trading with Merrill Edge.

Table of Contents

Introduction to Merrill Edge Extended Hours Trading

Extended hours trading encompasses sessions before and after the regular market period. This means traders can buy and sell securities outside the standard trading hours, providing a unique advantage, especially when significant news or events occur outside the regular session.

Advantages of Extended Hours Trading

One of the primary benefits of extended hours trading is the ability to react to news and events that occur outside the regular trading session. For instance, US-listed companies often release earnings outside of standard market hours. If there’s a surprise announcement, traders can act swiftly, potentially capitalizing on significant price movements before the regular session begins.

Merrill Edge Trading Start Time

Merrill Edge’s pre-market session commences at 7:00 am EST. This is in contrast to some other brokers, like Webull, which starts its pre-market session at 4:00 am EST, boasting one of the longest extended trading hours in the industry.

Overview of Merrill Edge Extended Hours Trading

Merrill Edge offers trading both before and after regular market hours. This flexibility can be particularly advantageous when there are unexpected announcements or significant economic news released outside of the standard trading hours.

Trading Time Details

Merrill Edge’s pre-market session begins at 7:00 am EST and concludes at 9:30 am. However, it’s worth noting that while orders can be placed starting at 7:00 am, they aren’t sent to the electronic communications network (ECN) until 8:00 am. The after-hours session for Merrill Edge traders runs from 4:01 pm until 8:00 pm.

Merrill Edge Extended Hours Trading Fees

Merrill Edge has set a limit for its customers to trade up to 100,000 shares per order during extended hours. This is notably higher than some competitors. While there are inherent risks associated with trading outside of regular hours, such as heightened price volatility, Merrill Edge does not impose any additional surcharges for trading during these times. However, traders should be aware of potential larger bid-ask spreads during these sessions.

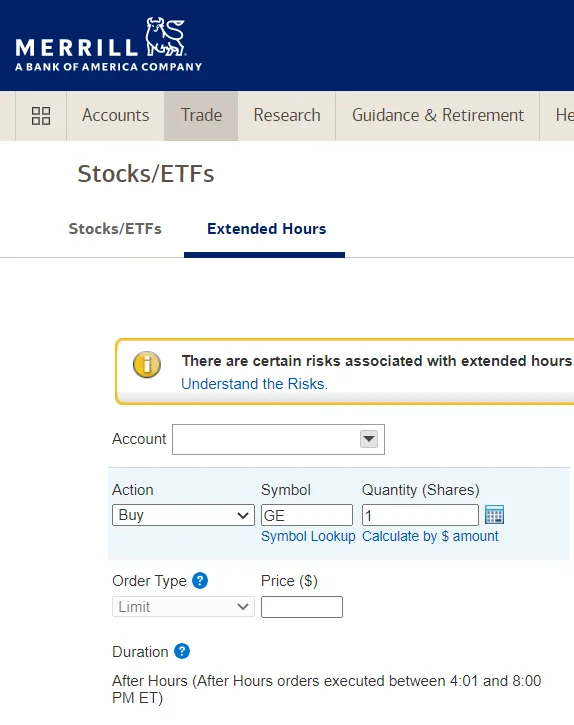

How to Enter Extended-Hours Orders

Orders placed during the pre-market or after-hours sessions do not carry over to subsequent trading sessions. If an order isn’t executed during the pre-market, it will be automatically canceled at the end of that session. Merrill Edge provides various trading tools, including its website, mobile app, and advanced desktop platform, to facilitate orders during these extended hours.

Trading on Weekends with Merrill Edge

While the stock market remains closed over the weekend, traders can still access and use the Merrill Edge website and app. However, any modifications to investments made during the weekend will only take effect on the subsequent business day.

Merrill Edge Fee Structure

Merrill Edge has evolved over the years, adapting to the changing landscape of brokerage fee structures. Today, they offer a streamlined fee schedule that’s easy to understand. Retail investors can trade stocks and ETFs at $0, with no special assessments or fees for penny stocks. This competitive fee structure places Merrill Edge in a favorable position among its peers.

Conclusion

Merrill Edge’s extended hours trading offers traders a unique advantage, allowing them to act swiftly to market changes and news outside of regular trading hours. With its user-friendly platforms and competitive fee structure, Merrill Edge stands out as a top choice for both novice and seasoned traders.

Get More Info: Merrilledge.com

FAQs

1. Does Merrill Edge have extended hours trading?

Yes, Merrill Edge offers extended hours trading. This includes sessions before and after the regular market period where securities can be bought and sold. Extended-hours trading can be particularly advantageous when significant news or events occur outside of the regular trading session.

2. How do I trade after hours on Merrill?

To trade after hours on Merrill Edge, you can use their trading tools, including their website, mobile app, and advanced desktop platform. Orders submitted during the after-hours period do not carry over to subsequent sessions. An order that doesn’t get filled during the after-hours will automatically be canceled at the end of the session. Before trading, Merrill requires its customers to agree to an extended-hours document.

3. How can I trade in extended hours?

To trade in extended hours, you would need to use a brokerage platform that offers this service, like Merrill Edge. Once you have an account, you can place orders during the pre-market or after-hours sessions using the broker’s trading tools. It’s essential to be aware of the risks associated with extended hours trading, such as heightened price volatility and larger bid-ask spreads.

4. Can you trade stocks in extended hours?

Yes, you can trade stocks during extended hours if your brokerage offers this service. Merrill Edge, for example, provides extended-hours trading, allowing its clients to buy and sell stocks outside of the standard trading hours.

5. Which broker allows 24 hour trading?

While most brokers do not offer 24-hour stock trading, some platforms like TD Ameritrade’s Forex account allow Forex trading 23 hours per day, Sunday through Friday. Additionally, platforms like Webull offer cryptocurrency trading, which is available 24/7.

6. How many times can you day trade on Merrill Edge?

The article does not specify a limit on the number of day trades you can make on Merrill Edge. However, it’s essential to be aware of the “Pattern Day Trader” rule, which applies to all brokerage firms and requires traders to have a minimum of $25,000 in their accounts if they make four or more day trades in a five-day period.

7. Who can trade stocks at 4 am?

Brokers like Webull allow their clients to start trading as early as 4:00 am EST during the pre-market session. This is one of the longest extended trading hours in the industry.

8. Why can’t I trade stocks after hours?

Trading stocks after hours requires access to a specific extended-hours trading system, and not all brokers offer this. Additionally, there may be less liquidity, wider bid-ask spreads, and higher volatility during after-hours, making it riskier than regular trading hours.

10. How long does it take for a trade to settle on Merrill Edge?

Typically, for U.S. stock exchanges, the standard settlement time for trades is two business days after the trade date (known as T+2). This might be the case for Merrill Edge as well, but I would recommend checking their official documentation or contacting their customer service for precise information.

11. What is the difference between Merrill Lynch and Merrill Edge?

Merrill Lynch is a traditional wealth management and brokerage firm, while Merrill Edge is a more modern, online-focused brokerage platform. Merrill Edge was developed to cater to the evolving needs of investors and to offer a more streamlined and digital experience.

12. Does Merrill Edge allow futures trading?

Based on the information retrieved from the Merrill Edge website, there is no specific mention of futures trading. The site primarily discusses their investment products, services, and offers, but does not explicitly state whether they allow futures trading.

To get a definitive answer, it would be best to consult Merrill Edge’s official documentation, visit their trading platform, or contact their customer service directly.

13. Why does it take 2 days to settle a trade?

The standard settlement period for most trades is two business days, known as T+2. This is a regulatory requirement and gives both parties time to fulfill their obligations, including the transfer of securities and payment.

14. Is Merrill Edge commission-free trades?

Yes, Merrill Edge offers commission-free trades for stocks and ETFs. However, other fees may apply, depending on the type of trade or service.

15. How do I get my money out of Merrill Edge?

Typically, you can request a withdrawal through the broker’s website, app, or by contacting their customer service.

16. What are the extended trading hours for Merrill Edge?

Merrill Edge’s pre-market session runs from 7:00 am to 9:30 am EST, and the after-hours session is from 4:01 pm to 8:00 pm EST.

17. Are there additional fees for trading during extended hours with Merrill Edge?

No, Merrill Edge does not charge extra fees for trading during extended hours.

18. Can I trade on weekends with Merrill Edge?

While you can access the Merrill Edge platform over the weekend, the stock market remains closed, so trades will be executed on the next business day.

19. How does Merrill Edge’s extended hours trading compare to other brokers?

Merrill Edge offers a comprehensive extended hours trading session, starting earlier than some competitors and providing flexibility to its traders.

20. Is there a limit to the number of shares I can trade during extended hours with Merrill Edge?

Yes, Merrill Edge has set a limit of 100,000 shares per order during extended hours.

[…] Read More: Merrill Edge Extended Hours Trading […]